An integrated investment approach to liquidity management

Legal and General Investment Management provides a range of liquidity solutions. These are relied upon by a wide range of clients, including multi-national corporates, pension funds, sovereign wealth funds and not-for-profit organisations.

To support operational cash management, same-day liquidity and daily price stability, we offer Liquidity Funds in Sterling, US Dollars and Euros.

We also offer bespoke separate account capabilities in a variety of currencies.

Liquidity funds

The table below provides a brief overview of our UCITS compliant fund range:

| LGIM Liquidity | LGIM Liquidity Plus | |

|---|---|---|

| Objective | To provide investors with daily capital stability and daily liquidity | To provide investors with capital stability and an increased return target over a longer term horizon (6-12 months). |

| Fund structure | EU UCITS | EU UCITS |

| Currencies available | GBP; USD; EUR | GBP |

| Type | Short Term Money Market Fund | Ultra Short Duration Bond Fund |

| Settlement | T+0 | T+2 |

| External rating* | S&P AAAmf; Moody’s Aaa-mf; Fitch AAAmmf | Fitch AAAf/S1 |

| Pricing structure | Low Volatility Net Asset Value (LVNAV) | Variable Net Asset Value (VNAV) |

| SFDR Categorisation: | Article 8 | Article 8 |

*Fund ratings were solicited and financed by LGIM Liquidity Funds Plc.

Investment process

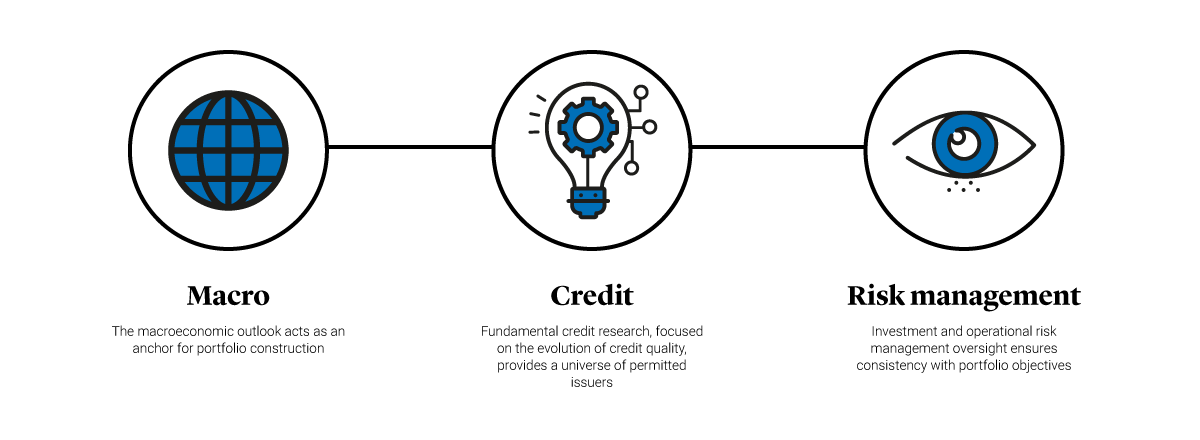

We have a three-pillar approach to the liquidity funds investment process which draws on LGIM’s broader capabilities.

Team

LGIM has a team-based approach to liquidity management which forms a strategic part of our asset management capability, incorporating liquidity and short duration portfolios as well as securities financing. The team has over 16 years' average experience managing and trading liquidity assets.

Key risks

The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested. The risks associated with each fund or investment strategy should be read and understood before making any investment decisions. Further information on the risks of investing is available from LGIM’s Fund Centres.

While LGIM has integrated Environmental, Social, and Governance (ESG) considerations into its investment decision-making and stewardship practices, this does not guarantee the achievement of responsible investing goals within funds that do not include specific ESG goals within their objectives.