By Rita Butler-Jones, Head of DC

In just three years we’ve had the visceral shock of the pandemic, fears that warfare overseas could undermine domestic stability and, of course, the cost-of-living crisis. Expecting UK workers to prioritise their pensions could be a tough ask right now. Yet our latest research1 suggests that when people understand that their pensions aren’t only a personal retirement savings tool but can help influence some of the most critical factors affecting their lives, they are generally keen to engage.

In this year’s investigation into the ESG (environmental, social and governance) views of our DC (defined contribution) pension members – the fourth in a series of similar exposés – we found that support for ESG investments in pensions depends largely on how well the pensions industry – including providers like us at Legal & General Investment Management (LGIM) – communicate to members how pension power works.

What do they know?

Most of the 3,634 UK DC pension members in the accumulation phase that we surveyed know that their pension savings are invested. They also know that this means they own little bits of companies and that, collectively, pension funds own large parts of businesses (68% said they were either very or vaguely aware of this).

And when they know that their pension money can be used to encourage companies to behave better in terms of their ESG practices, 84% of our DC members say they would have wanted to be more involved in their pensions if they’d known it was being used to drive positive ESG changes.

What do they care about?

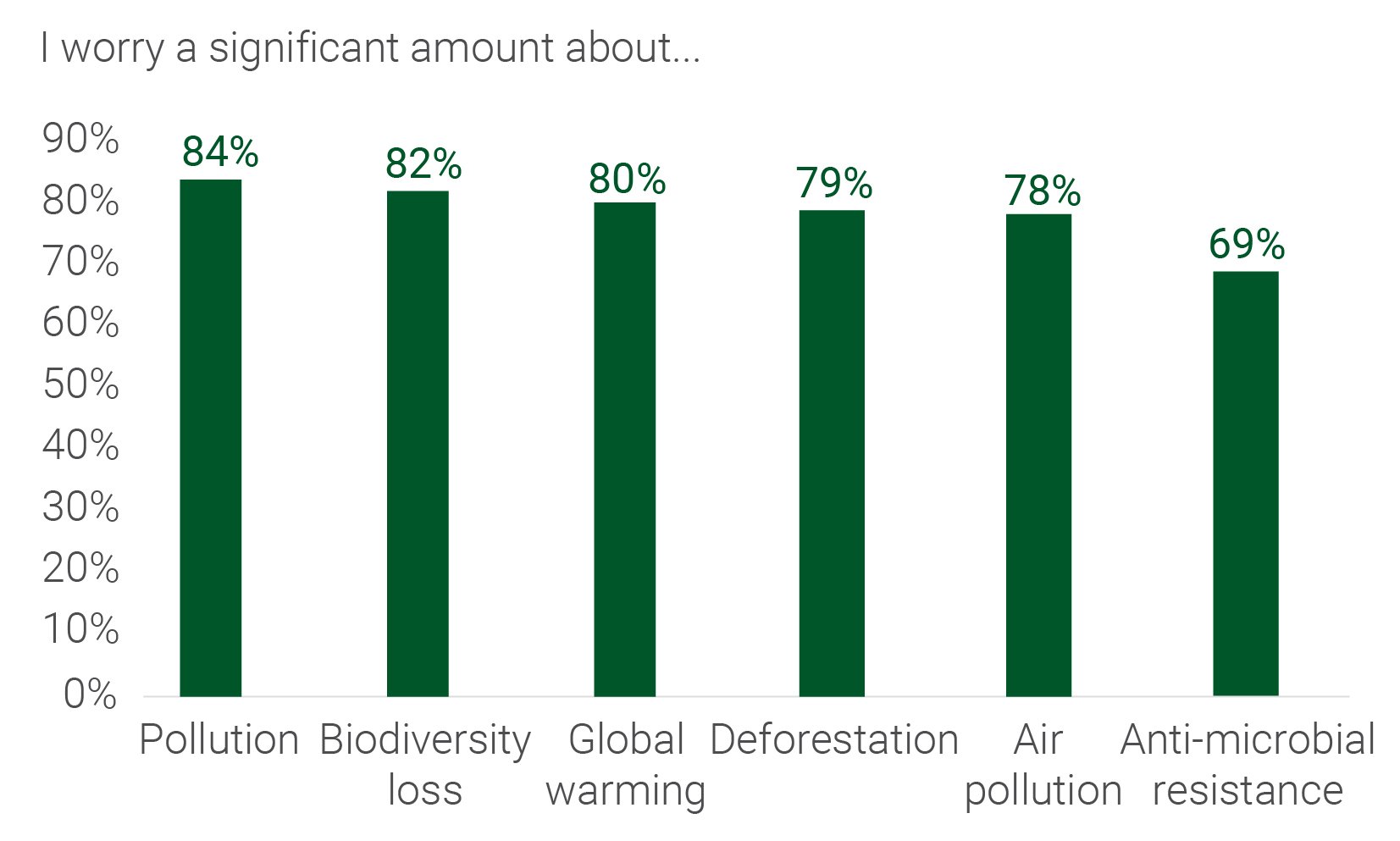

In terms of the environmental issues that most concern our DC pension members, 84% worry about pollution of rivers, lakes and seas, 82% worry about biodiversity loss (loss of plants and animals) and 80% say they worry a fair amount or a lot about climate change.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

Our DC members also worry about the loss of tropical rainforests including the Amazon (79%), and air pollution (78%).

The overuse of antibiotics is on the minds of a lesser amount (69%), but this might change as the risks of antimicrobial resistance and familiarity with the term itself, continue to gain traction in the media.

Awareness of net zero continues to grow and 85% of our DC members say they’ve heard of it, despite no significant change in members’ understanding of how it’s relevant to their pension.

However, most DC pension members now seem to appreciate the link between burning fossil fuels and global warming so that almost nine in 10 (87%) want their pensions to significantly reduce their exposure to fossil fuels.

Again, once they know that having a pension with a net-zero target would mean balancing the money invested in carbon-intensive businesses against other lower carbon investments, 70% of our DC members say they’d support net-zero targets – as long as it didn’t affect the financial performance of their fund.

Despite the general hesitancy around fund performance, 17% said they’d support net-zero targets regardless of the impact on financial performance and around six in 10 (58%) would be willing to pay more in fees to have a pension with a net-zero target.

While it’s by no means universal, there is, on balance, slightly more confidence in the potential of ESG investing. For instance, 55% of members say they think funds with net-zero targets will do better than those without, while 57% think pension funds that invest in green finance will perform better financially than funds which don’t.

One area that will need to be worked on in terms of raising awareness is ‘green finance’ (loans or investments that promote environmentally positive activities).

Only around half of our DC members have heard of it, but once they have, six in 10 say they’d pay higher fees to support it.

Arguably, the cost-of-living crisis and geopolitical instability, such as the war in Ukraine, have made pension members feel more vulnerable to the potential of global disruption to undermine their future financial security.

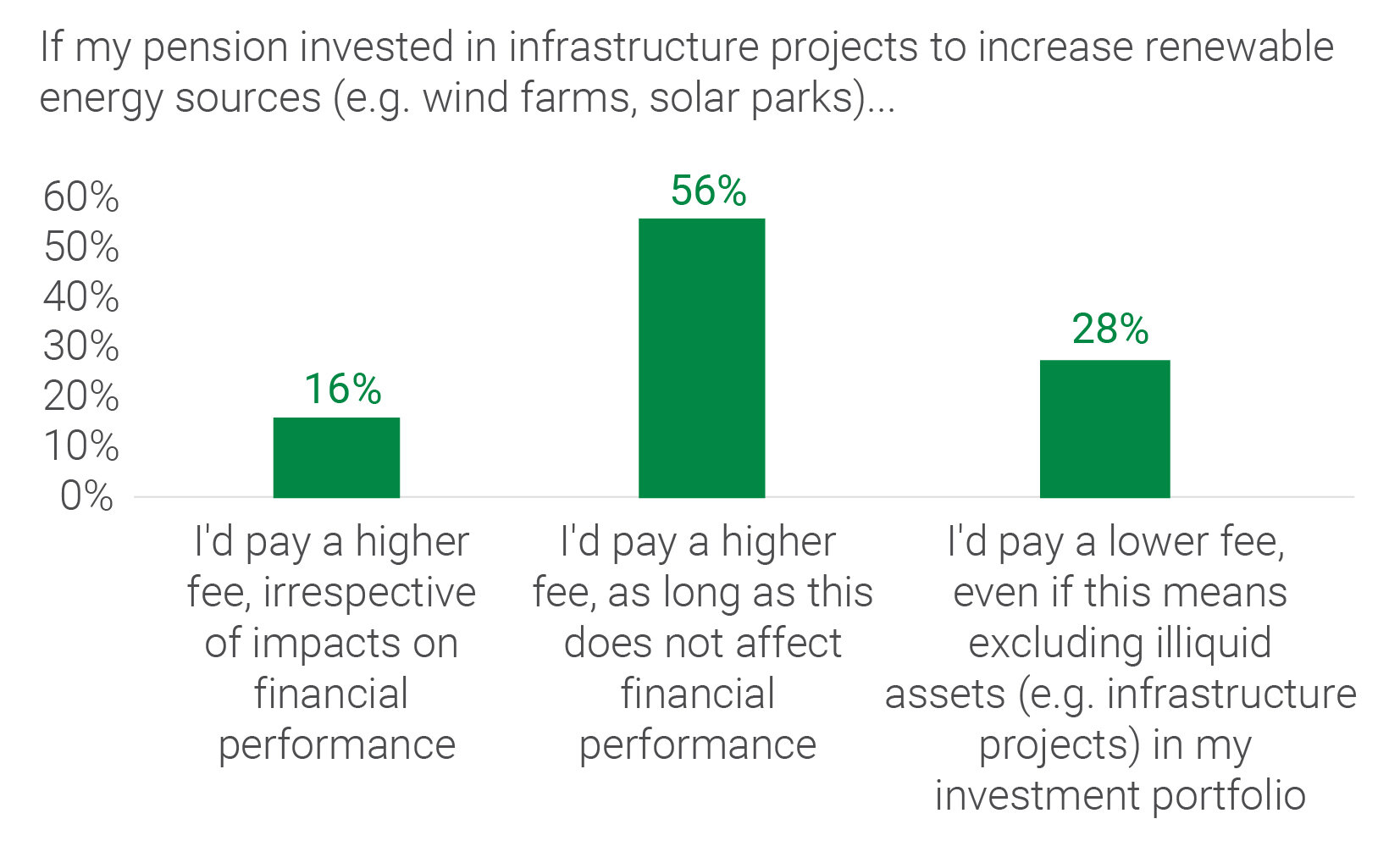

For example, a conclusive 72% of members would pay higher fees for pensions which supported investments in infrastructure projects to increase renewable energy sources such as wind farms or solar parks. Meanwhile, three-quarters say that rising prices has made them think more about how we can sustainably produce food.

Divest or engage? How DC members want to use pension power

For our DC members, the most popular course of action is to use the power of pensions to work with companies to change poor ESG behaviours. But only up to a point. If persuasion isn’t successful, members are happy to see their pension provider walking away from these companies.

For instance, more than half (55%) of members would like to see their pension provider engaging with companies on improving their environmental practices and only withdrawing from them if this doesn’t work, compared with 33% who would prefer to avoid companies with a poor environmental record altogether.

Our members are slightly less forgiving of companies which aren’t performing well in terms of their social practices, such as their record on modern slavery. Less than half (45%) think their pension provider should keep investing with them to effect change and only divest if they don’t improve. A sizeable 43% wouldn’t want their provider engaging with companies with a poor social record at all.

Raising awareness raises engagement

The global economic and political turbulence of recent years will have left many of us feeling battered, bruised and maybe, somewhat vulnerable to the unpredictability of where the next financial shock might come from.

Yet, in one of the most extensive pieces of research into DC pension members’ views that we’ve ever conducted (4,678 people)2, we found that knowledge is power when it comes to understanding how pension investments may offer savers a way of influencing some events that they might previously have considered to be way beyond their control.

Once members understand how their investment funds link to wider environmental and societal issues through the power of shares, most of our members become more interested in their pensions. This isn’t just good for them in terms of engagement, but it’s good for the companies in which their provider invests and good for the provider itself.

For instance, we used case studies to help bring the power of pensions to life in the minds of pension members. When we showed our members these examples of how we at LGIM have worked with companies to encourage them to do better on issues such as reducing carbon emissions or paying the real living wage to their employees, eight in 10 (81%) said they’d be more likely to engage with their pension if they’d known it was being used in this way.

And 60% said they felt more positive about the companies that were working with their pension provider on changing ESG behaviours, while 72% said that after hearing examples of LGIM’s work with companies to encourage better ESG behaviours, they’d feel better about us as a company.

DC members generally appreciate simply being kept in the know with 65% saying they’d feel more positive about their pension provider if they were kept informed about how the provider was using the investor rights that come with managing pension funds.

It's understandable that, given the cost-of-living crisis, there remains some degree of nervousness around taking any steps that might have unintended consequences for the long-term performance of a scheme member’s pension pot. However, this, again, reveals the need for better education and reassurance from the pensions industry around the financially material risks of ESG issues.

For example, despite a conclusive 72% of savers supporting investments in infrastructure projects to increase renewable energy sources such as wind farms or solar parks, well over half (56%) would only back paying higher fees if there was no long-term impact on their pension pots.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

However, at LGIM, we believe that responsible investing is essential to mitigate risks, unearth investments opportunities and strengthen long-term returns for those who invest with us – and our research has shown time and again, that once pension savers understand the principles behind responsible investing, they feel more comfortable with having these principles incorporated into the decision-making process around how their pension funds are invested.

The key will be for all of us involved in the pensions industry – whether regulators, providers or employers – to work together on filling the knowledge gap around pension investments so scheme members understand that there’s much more to a pension fund than providing a retirement income. It also gives them a stake in helping to shape the world into which they’ll eventually retire.

How we did it:

We performed quantitative research using a questionnaire for 4,678 defined contribution workplace pension savers. The survey was completed in June 2023. Our respondents were split across generations and genders and across the UK and Ireland. This article refers to UK figures for DC members in the accumulation phase. A separate report is available for our research into the ESG views of Irish DC scheme members.

|

Type of saver |

No. respondents |

|

UK accumulation |

3634 |

|

UK decumulation |

500 |

|

Ireland |

544 |

We define the generations as:

Baby Boomers: Born between 1946 and 1964

Generation X: Born between 1965 and 1980

Millennials: Born between 1981 and 1996

Generation Z: Born between 1997 and 2012

[1] Legal & General Investment Management (LGIM) survey in June 2023 of the views of 4,678 defined contribution workplace pension savers on environment, social and governance investing. Respondents were split across generations and genders and across the UK and Ireland.

[2] See the How we did it graphic.

Key Risk Warnings

Past performance is not a guide to future performance. For professional investors only. The value of investments and the income from them can go down as well as up and you may not get back the amount invested. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.

Further reading

ESG in DC: UK member research 2023

Despite the cost-of-living crisis, ESG investing remains a priority for most DC members. Our research suggests that many would even be prepared to pay higher fees to see their funds supporting ‘green’ initiatives.