By Jesal Mistry, Interim Head of DC Investments

They might be unfamiliar with the term ‘illiquids’, but our recent research1 suggests that most DC pension members want them. So, what lies behind this enthusiasm, especially when it comes to investing in infrastructure that supports sustainable supplies of food and energy, affordable housing and local job creation? And how does this feed into the great debate on illiquids in DC?

Back in July, nine leading UK pension providers, including Legal & General, signed up to the UK Government’s Mansion House Compact, committing themselves to allocating 5% of assets in their default pension funds to unlisted equities (illiquids2) by 20303.

The compact marked a rise in the temperature of the debate on illiquids in DC that has been simmering away in the UK and Europe for a few years now.

The argument in favour of illiquids is that these type of investments could unlock more money for DC pension funds while investing in the country’s overall economic growth. However, there is also a general acceptance that there will need to be additional safeguards introduced to minimise risks and seek to achieve best value for savers.

Yet even as the pensions industry and its regulators hammer out the details of introducing and/or increasing investments in private markets into DC funds, LGIM’s latest look at our DC pension members’ views on environment, social and governance (ESG) issues4 found that from their perspective, these type of investments appear to be rather popular already. Whether or not DC savers have even heard of illiquids.

In fact, so keen on illiquids are our DC members that the majority of the 3,634 that we interviewed in the UK would be prepared to pay higher pension fees to have them – which is noteworthy given that our survey was carried out at a time of rising prices, and just months after the Office for National Statistics estimated that consumer price inflation was the highest in more than 40 years5.

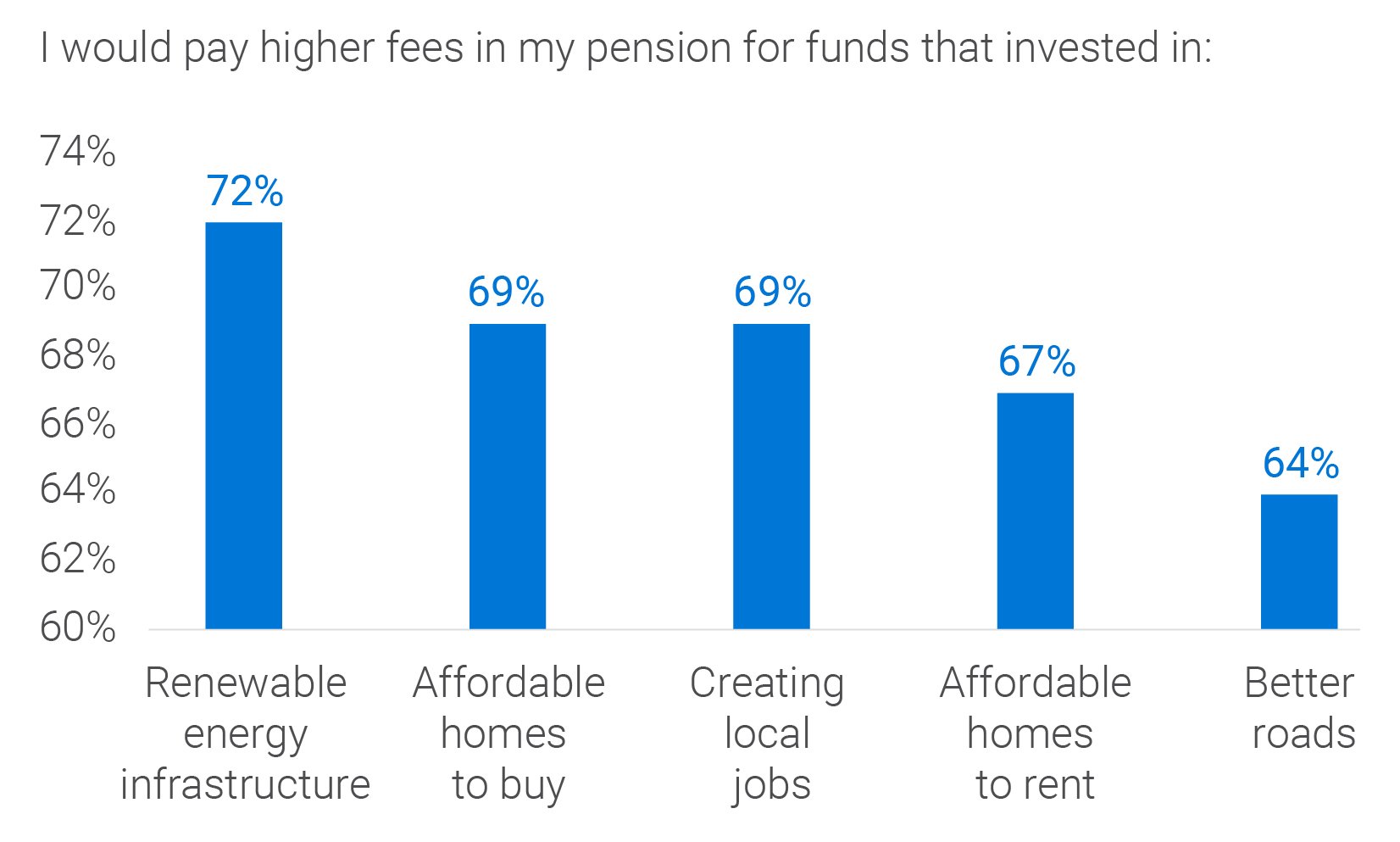

Almost three-quarters (72%) of our surveyed UK DC members said they’d pay higher fees to invest in infrastructure that supported renewable energy sources, such as solar parks and wind farms.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

Similar numbers said they’d pay higher fees for funds that invested in other assets such as affordable homes and better roads.

Higher pension fees for illiquids: a worthwhile drop in the cost-of-living ocean?

Perhaps counter-intuitively, I suspect it’s likely to be the cost-of-living crisis and rising prices that lies behind our DC members’ resignation to increase their outgoings – in this case for higher pension fees – to invest in projects that might help make the UK less dependent on global factors affecting economic stability.

For instance, when asked if rising prices had made them think harder about investing in renewable energy and sustainable food production, most of our respondents said it had. Some 65% said it had made them more interested in sustainable energy sources (rising to 67% for men compared with 62% of women) and 69% for our youngest group, the Generation Zs.

These figures were even higher for those thinking harder about food security because of price rises, with 74% turning their attention towards sustainable food sources. Women were the most interested in this at 78% compared with 71% of men.

When it comes to balancing sustainable infrastructure investments with the effect this might have on their long-term pension returns, most of our respondents were more hesitant about their commitment.

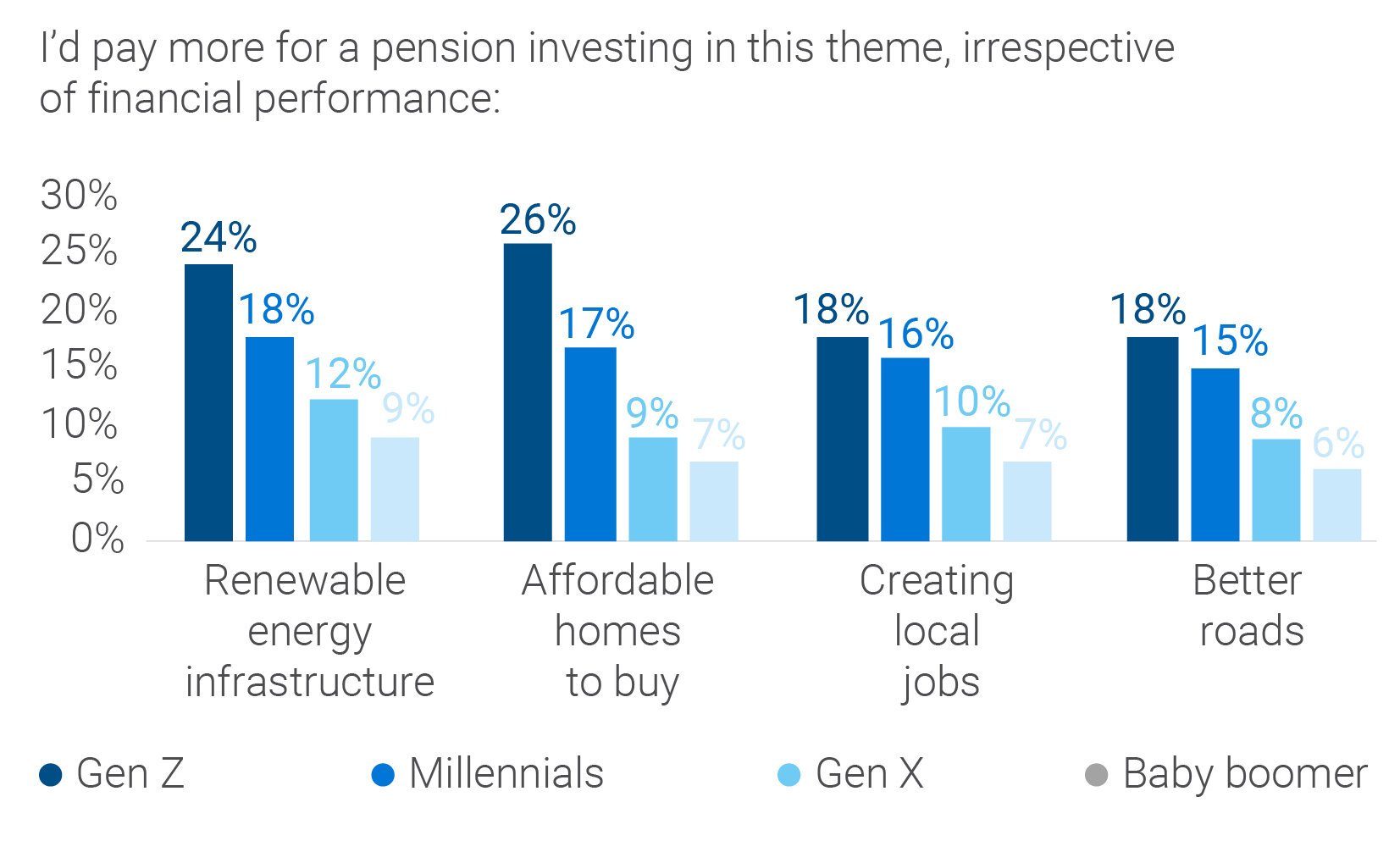

In every case of illiquid infrastructure investments that we asked about in our survey (renewable energy, sustainable food supply, affordable homes, better roads and local jobs) over half of respondents said they’d pay higher fees to have their pensions invested in this way, but only if there was no impact on their fund’s performance.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

However, some of those we surveyed said they’d pay regardless of the implications for the performance of their pension fund. Around 15% overall said they’d pay despite any possible loss of performance with younger generations taking the hardest line (roughly, 25% of Generation Zs compared with 7% of Baby Boomers).

What now for illiquids?

The cost-of-living crisis has taken its toll on our savers. Nine in 10 of those we interviewed described themselves as either having less disposable income, just about managing or downright struggling in the year leading up to our survey in June 2023.

With 90% feeling a financial squeeze, our research appears to suggest that among DC pension savers at least, rising prices have made them think harder about their, and the wider UK’s, long-term economic resilience.

It’s not inconceivable that recent events such as COVID-19 and the war in Ukraine, have lowered confidence in global economic stability and pension savers are looking to invest in sustainable projects that could make them less dependent on, for example, overseas fuel and food.

Whatever the reasons, the sense of vulnerability to the vagaries of the global economy appears to drip through our research results, watering the ground for illiquids in DC.

It’s now up to regulators, pension providers and trustees to respond to this with illiquid investments that work in the best interests of DC scheme members. Unpicking how we’ll all go about doing this, would need another blog.

How we did it:

We performed quantitative research using a questionnaire for 4,678 defined contribution workplace pension savers. The survey was completed in June 2023. Our respondents were split across generations and genders and across the UK and Ireland. This article refers to UK figures for DC members in the accumulation phase. A separate report is available for our research into the ESG views of Irish DC scheme members.

|

Type of saver |

No. respondents |

|

UK accumulation |

3634 |

|

UK decumulation |

500 |

|

Ireland |

544 |

We define the generations as:

Baby Boomers: Born between 1946 and 1964

Generation X: Born between 1965 and 1980

Millennials: Born between 1981 and 1996

Generation Z: Born between 1997 and 2012

[1] Legal & General Investment Management (LGIM) survey in June 2023 of the views of 4,678 defined contribution workplace pension savers on environment, social and governance investing. Respondents were split across generations and genders and across the UK and Ireland. This article refers to UK data only.

[2] Broadly speaking, illiquids are assets that can’t quickly and easily be sold or exchanged for cash.

[3] UK Government news story, 10 July 2023: www.gov.uk/government/news/chancellors-mansion-house-reforms-to-boost-typical-pension-by-over-1000-a-year.

[4] Legal & General Investment Management (LGIM) survey in June 2023 of the views of 4,678 defined contribution workplace pension savers on environment, social and governance investing. Respondents were split across generations and genders and across the UK and Ireland. This article refers to UK data only.

[5] Office for National Statistics: www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/june2023:“The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May, and down from a recent peak of 9.6% in October 2022. Our Indicative modelled consumer price inflation estimates suggest that the October 2022 rate was the highest in over 40 years…”

Key Risks

Past performance is not a guide to future performance. For professional investors only. The value of investments and the income from them can go down as well as up and you may not get back the amount invested. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.

Further reading

ESG in DC: UK member research 2023

Despite the cost-of-living crisis, ESG investing remains a priority for most DC members. Our research suggests that many would even be prepared to pay higher fees to see their funds supporting ‘green’ initiatives.