A cura di Rita Butler-Jones, Head of DC

In one of the toughest economic climates in decades, UK workers might be forgiven for being wary of having to pay more for anything. Yet our latest research1 suggests that most DC pension savers would be prepared to pay higher fees to see their pension funds supporting ‘green’ initiatives.

In this year’s investigation into the ESG (environmental social and governance) views of our DC pension members, we expected to find that the cost-of-living crisis was making savers more cautious with their cash.

Yet, in one of the most extensive pieces of research into DC pension savers’ views that we’ve ever conducted2, we found that most would pay more for investments which could make them less vulnerable to long-term financial risks.

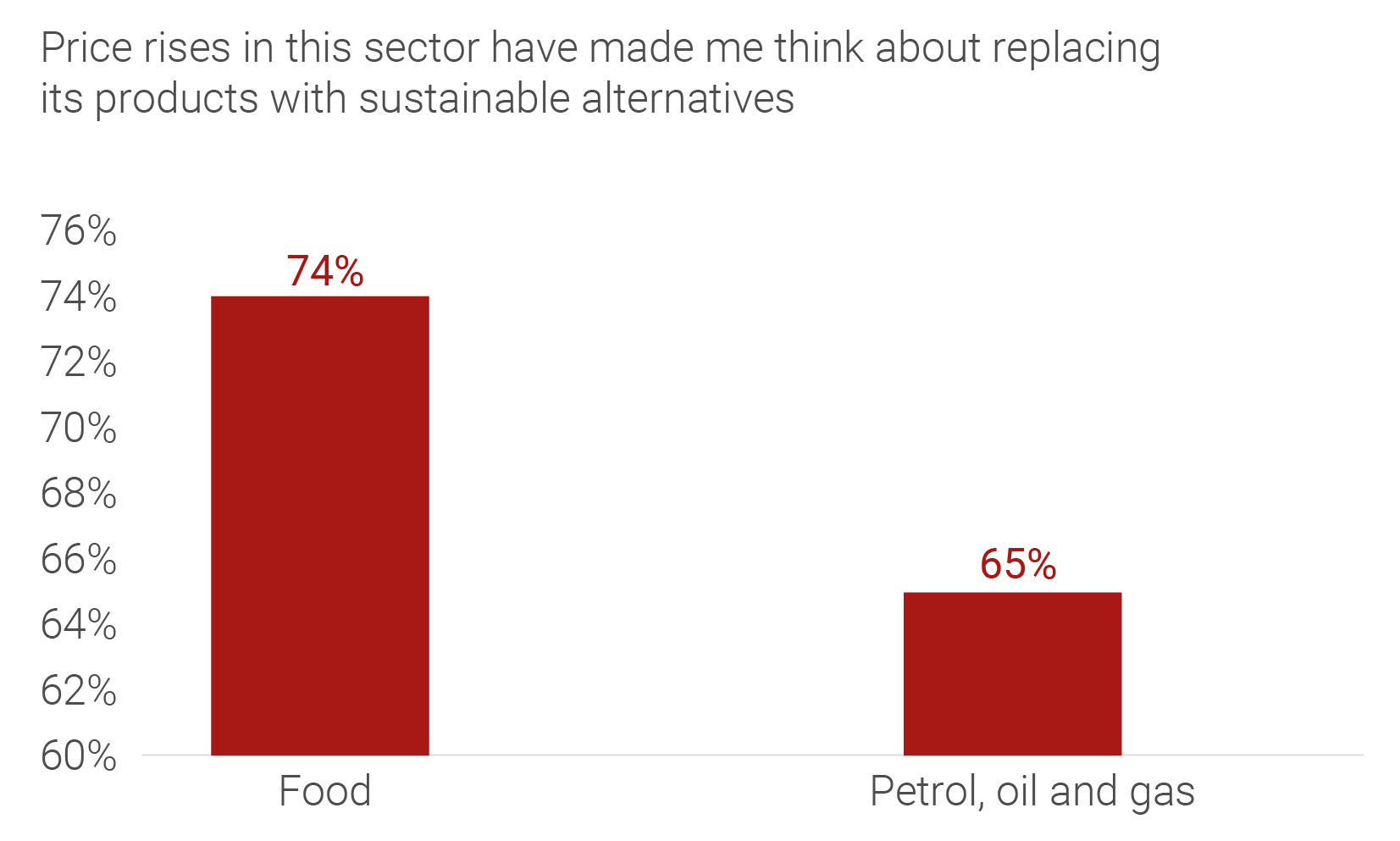

For instance, of the 3,634 DC pension members we interviewed in the UK, 65% said the rise in petrol, gas and oil prices had made them more interested in replacing oil and coal with sustainable energy sources such as wind or solar farms.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

And an even higher number (74%) said that rising food prices had made them think more about how we could sustainably produce food. Women were the most interested in this at 78% compared with 71% of men.

The general willingness to pay higher fees to invest their pension funds in certain ESG initiatives is particularly noteworthy when we think about the economic circumstances under which our respondents were surveyed.

We completed our survey in June 2023, just months after the Office for National Statistics estimated that consumer price inflation was the highest in more than 40 years3.

And our survey showed that few of those we interviewed had escaped the effects of rising costs and interest-rates. In fact, 90% described themselves as either having less disposable income, just about managing or downright struggling.

Given this backdrop, it appears that our respondents have mostly understood, or are beginning to understand, that there’s a connection between the need to manage environmental and societal risks in case these have a knock-on effect on the long-term stability of the UK economy, and ultimately, on their retirement savings.

ESG at any price?

By no means all of our DC pension savers support investing in funds which support ESG objectives. However, our respondents are generally prepared to consider these issues as worth incorporating into long-term investment strategies.

For instance, we found that despite their own financial troubles, most of our DC savers want to see action being taken to tackle climate change (80%). Many worry (71%) that climate change will push up prices even further with women particularly concerned (76% compared with 68% of men).

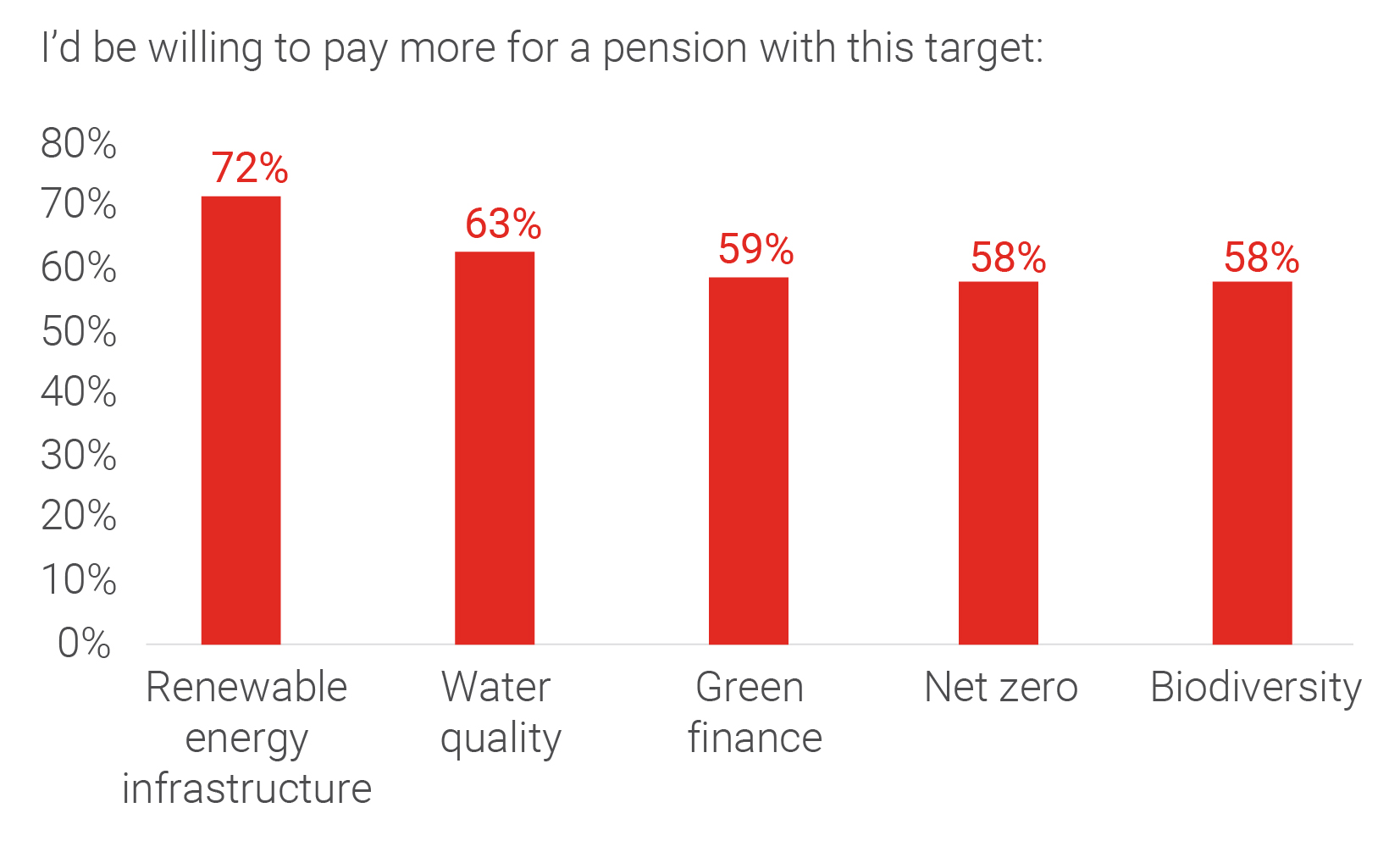

With more of our DC members than ever saying they’re familiar with the term ‘net zero’ in relation to climate change, (85%), around six in 10 (58%) say they’d be prepared to pay more in fees for a pension with net-zero targets.

It's a similar picture when it comes to supporting the switch away from investing in fossil fuels with 87% saying they’d like to see their pensions significantly reducing their exposure to the fossil fuel industry.

However, there remains concern that this should not come at any price. While 21% of respondents, mostly in the Gen Z and Millennial groups, said they’d be prepared to move away from investing in fossil fuels even if their pension savings took a hit, most (66%) would only support this if there was no effect on the financial performance of their pension pots.

However, despite some understandable reticence about possible risks to the financial health of their pension pots, our DC savers tentatively support the concept of ‘green finance’ (loans or investments that promote environmentally positive activities).

Around half have heard of green finance and once it’s explained, six in 10 say they’d pay higher pension fees to support it.

When it comes to seeing their pension investments used to support particular green finance initiatives, there were some clear favourites. Almost 60% (58%) said they’d pay more for a pension which supported taking action to improve biodiversity and 63% said they’d pay more to see against taken against water pollution.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

Yet, there’s a difference between being prepared to pay more up-front in fees and accepting a potential dent in your savings when you come to retire. As we saw with our question on moving away from fossil fuels, enthusiasm for investing in ESG projects is generally tempered by the thought of losing out on long-term returns.

In most cases, while a hard core of DC savers might be sanguine about the effect on their savings, most respondents waver in their support.

For example, despite a conclusive 72% of savers supporting investments in infrastructure projects to increase renewable energy sources such as wind farms or solar parks, well over half (56%) would only back paying higher fees if there was no long-term impact on their pension pots.

As many more start to connect the dots between financial risks and poor ESG practices, this picture could well change. But for now, especially in these tough economic times, there remains an understandable element of cautiousness around anything that might affect long-term pension performance.

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

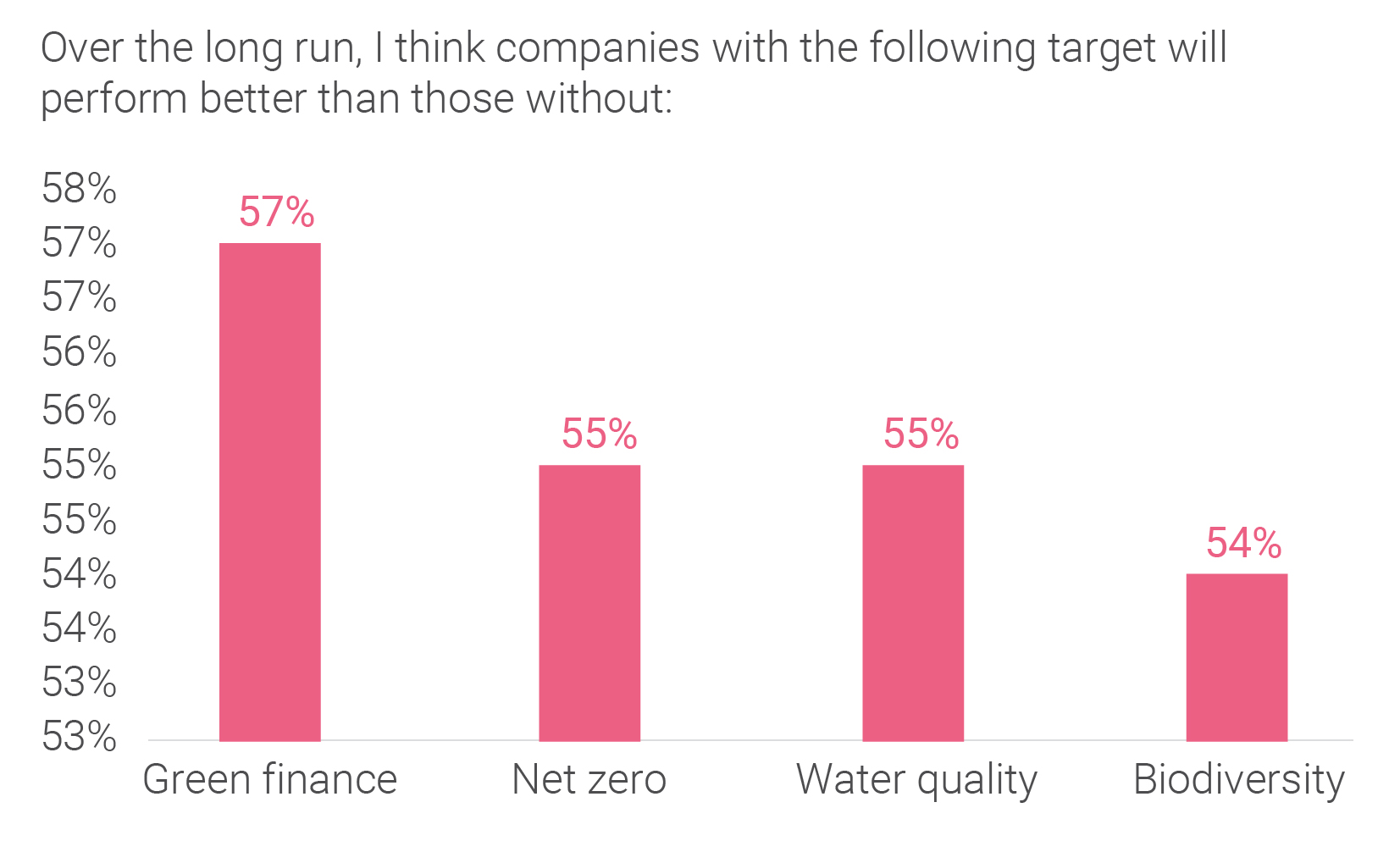

While it’s encouraging that the majority expect funds with net-zero targets and which invest in green finance to do financially better than those without these targets/green investments, (55% think funds with net-zero targets will do better, 57% think green finance investments will do better) around 20% remain to be convinced (19% think funds with net-zero targets will do worse, while 17% think green finance investments will do worse).

Appreciating the power of pensions

Our DC pension savers are mostly aware that their pension funds are invested and that this means they own bits of companies (68% describe themselves as being vaguely aware or very aware).

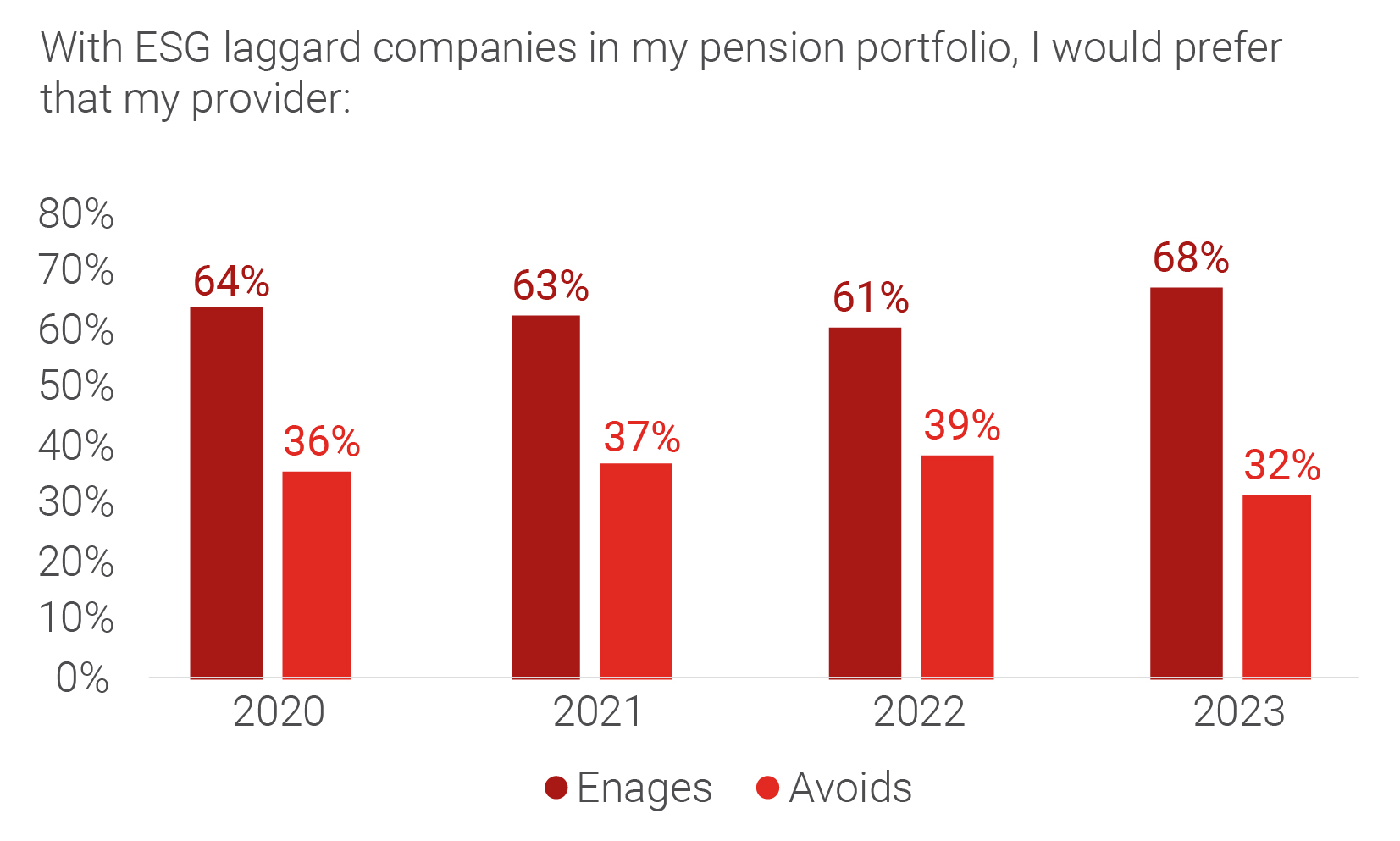

They are also keener than ever on seeing the power of their pensions used to influence the behaviour of companies in which their funds are invested.

The numbers who wish to avoid investing in companies with bad practices is down on last year from 39% in 2022 to 32% in 2023. Instead, our DC members would increasingly prefer to engage with these businesses to encourage them to change for the better (68% would prefer to engage compared with 61% last time we asked this).

Source: Legal & General Investment Management (LGIM) survey in June 2023 of the views of 3,634 defined contribution workplace pension members in the accumulation phase, on environment, social and governance investing. Respondents were split across generations and genders and across the UK.

However, in some cases, our savers draw the line. In terms of poor social practices such as modern slavery, 43% would still prefer asset managers to avoid investing their pension funds in companies exhibiting poor behaviour in this area – and not even attempt to engage with them on the issue.

Is the future bright for ESG investing?

It seems that despite the tough financial climate, DC pension savers are still thinking about the effect of that other big climate issue – global warming – and a range of additional ESG factors as they consider their pension fund investments.

While nine in 10 of those we interviewed have felt the effects of the cost-of-living crisis, the rising prices appear to have made them think harder about issues that may threaten long-term economic stability and are concluding that it probably makes sense to invest in schemes and businesses which aim to help mitigate the risks of ESG mismanagement.

In a year where we wouldn’t have been surprised to see our pension members pulling up the financial drawbridge and saying a hard no to anything that gives them yet more costs to manage, they’ve shown a general desire to remain engaged with ESG issues and have appreciated that what’s good for the environment, society and the way that organisations are run, is also likely to be good for their long-term financial wellbeing.

Of course, it isn’t a slam-dunk for ESG at any price and we wouldn’t expect it to be. But mostly, our DC members seem to be growing increasingly keen to use the power of their pensions to change behaviours that seek to help change the world for the better. And that, as an indication of the trajectory of member support for ESG investment principles, looks very much like a green light to us.

How we did it:

We performed quantitative research using a questionnaire for 4,678 defined contribution workplace pension savers. The survey was completed in June 2023. Our respondents were split across generations and genders and across the UK and Ireland. This article refers to UK figures for DC members in the accumulation phase. A separate report is available for our research into the ESG views of Irish DC scheme members.

|

Type of saver |

No. respondents |

|

UK accumulation |

3634 |

|

UK decumulation |

500 |

|

Ireland |

544 |

We define the generations as:

Baby Boomers: Born between 1946 and 1964

Generation X: Born between 1965 and 1980

Millennials: Born between 1981 and 1996

Generation Z: Born between 1997 and 2012

[1] Legal & General Investment Management (LGIM) survey in June 2023 of the views of 4,678 defined contribution workplace pension savers on environment, social and governance investing. Respondents were split across generations and genders and across the UK and Ireland. This article refers to UK data only.

[2] See the How we did it graphic.

[3] Office for National Statistics: www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/june2023:“The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May, and down from a recent peak of 9.6% in October 2022. Our Indicative modelled consumer price inflation estimates suggest that the October 2022 rate was the highest in over 40 years…”

Key Risks

Past performance is not a guide to future performance. For professional investors only. The value of investments and the income from them can go down as well as up and you may not get back the amount invested. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.

Further reading

ESG in negli schemi pensionistici a contribuzione definita: ricerca tra gli aderenti nel Regno Unito 2023

Nonostante la crisi del costo della vita, gli investimenti ESG continuano a rappresentare una priorità per la maggior parte degli aderenti a schemi pensionistici a contribuzione definita. Secondo le nostre ricerche, numerosi aderenti sarebbero addirittura disposti a versare commissioni più elevate per sostenere iniziative ‘verdi’ tramite i propri fondi.